Investing in gold is a long-term proposition; therefore, it’s best to use longer-term maturity debt instruments, such as the 10-year U.S treasuries, as a benchmark for comparison. We need to remember that gold is a non-yielding asset, meaning it doesn’t pay dividends, so the opportunity cost of holding gold increases with a real interest rate increase and decreases with a fall in real interest rates.

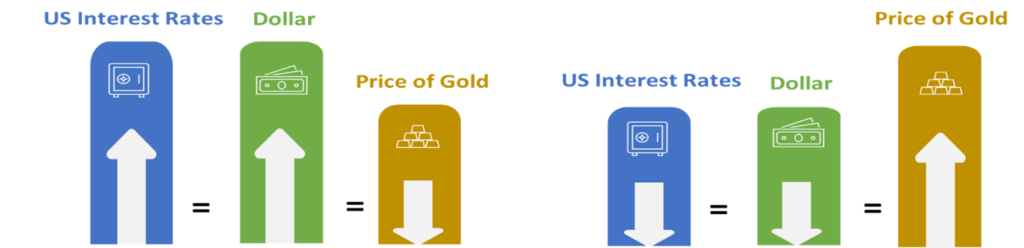

That being said, in simple terms, when yields on the 10-year U.S treasury bills increase, the value of the dollar also appreciates due to increased demand for the dollar, as it becomes more attractive for people to invest in higher-yielding U.S treasuries. As gold is primarily traded in dollars, a stronger dollar means a lower dollar price for gold, as it becomes more expensive to purchase gold; when that happens, demand for gold subsides, and so does its price.

Central banks fight high inflation by increasing interest rates; therefore, saving money in a high-interest rate environment becomes more attractive. This means people have less money to spend, slowing down economic activity and decreasing inflation. This in turn causes demand for gold to fall, which reduces prices.

On the other hand, if the outlook favors disinflation, yields on government securities drop. In times of low-interest rates, economic growth, and increased consumption patterns, the value of the currency tends to diminish as central banks inject more money to keep up with demand, which leads to higher inflation. As inflation rises, the value of gold also increases, as it is denominated in currency, like any other commodity or product. Moreover, in times of high inflation, investors also turn to gold as a safe-haven investment that stores its value better than currency, further increasing demand for gold and ultimately increasing prices.

As confidence in the global financial system wavers and the growth outlook continues to be weak, the future may be inflationary, and currencies will inflate further to deal with the predominated debt crisis. If the dollar and major currencies continue to lose value, people will turn to gold as a safe investment, which retains its value much better than any form of currency.