Focus Series

A Paradigm Shift in the Global Economy

The global economy currently faces supply-side pressures from the Covid-19 pandemic, rising inflation, high public spending and debt levels, and uncertainty about policy direction. Accordingly, GDP growth forecasts have been revised downwards by almost all IFIs, especially for advanced economies.

Read more

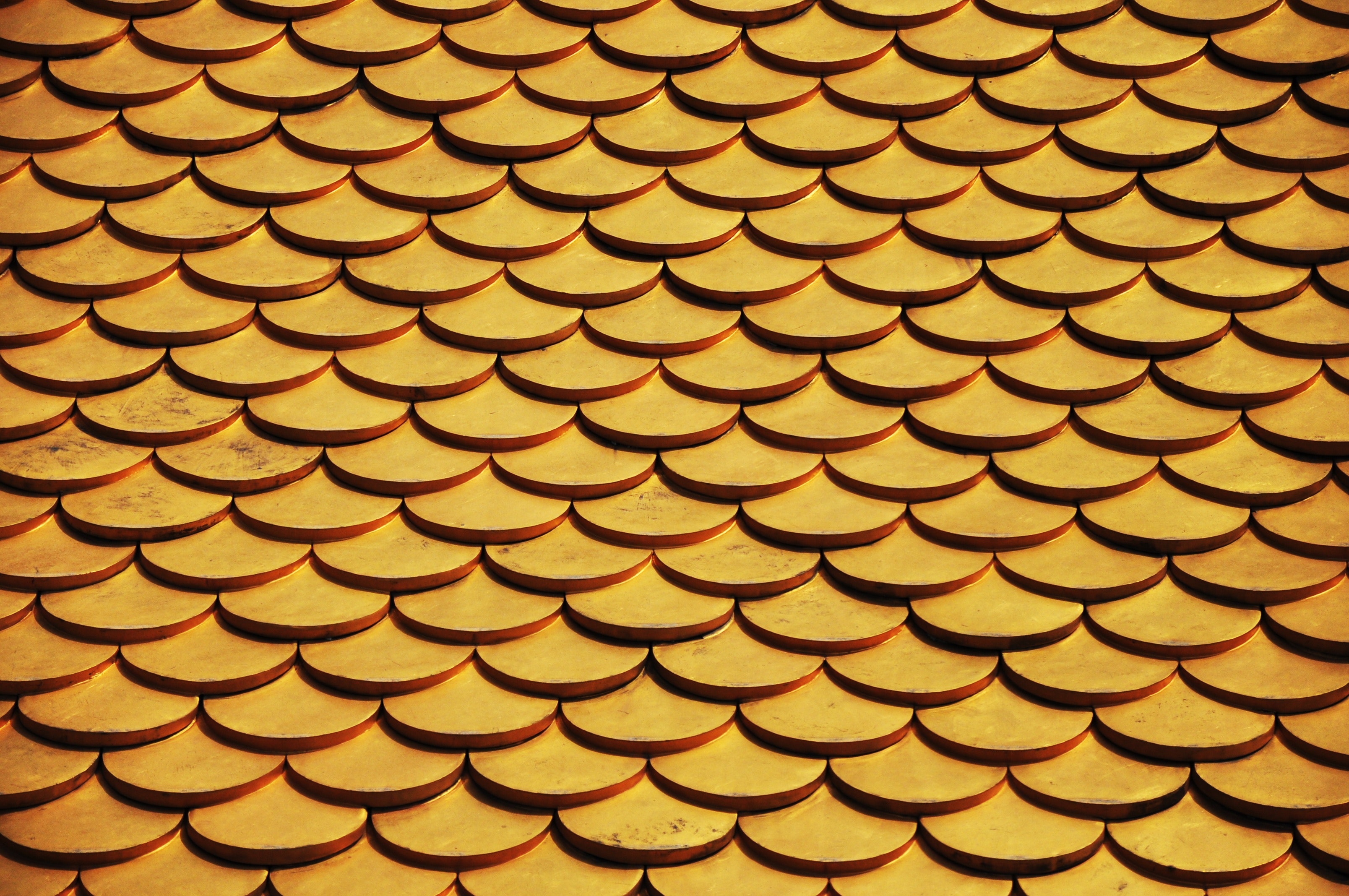

Gold & the History of the International Monetary System

During the late 1800s and leading up to the eruption of World War 1 in 1914, the Gold Standard was positioned as the predominant framework governing the world’s monetary system. Under this system, almost all currencies were...

Read more

The Central Elements of the Global Gold Market

The central elements of the global gold markets and supply chains include a wide range of participants, including mining companies, refineries, commodity traders, brokerage houses, logistics, and....

Read more

The Effects of Economic Crises & Political Tension on Gold Prices

Gold is considered one of the most secure investment options available, as the chances of gold losing its entire worth is almost non-existent. Gold prices may fluctuate but will not collapse entirely..

Read more

What Affects the Value of the Dollar?

In our previous editions, we illustrated how the US dollar index measures the value of the dollar against a basket of six other foreign currencies. We learned that after...

Read more

Understanding the U.S Dollar Index

As had been discussed in our previous spotlights, The Bretton Woods Agreement was established in 1944 to set a new monetary system and stabilize the world economy after World War II.

Read more

What Does the Future Hold for Gold?

Gold is affected by several variables, including interest rates, inflation, the value of the dollar, demand trends, and economic and political developments. The future direction of the U.S. Fed monetary policy, stock market volatility, a looming debt crisis....

Read more

How Interest Rates, Inflation & the Dollar Affect Gold Prices?

Investing in gold is a long-term proposition; therefore, it’s best to use longer-term maturity debt instruments, such as the 10-year U.S treasuries, as a benchmark for comparison...

Read more

What are the Different Types of Gold Investments?

Almost 50% of worldwide demand for gold originates from jewelry, which is mainly attributed to its ease of access and people’s inherent affinity for it. However, jewelry is...

Read more

Why Invest in Gold?

Gold is an abundant natural element found in almost all corners of the world. It has been utilized for thousands of years, both a medium of exchange and a valuable commodity. It has withstood the test of time and maintained its value through the ages as a means of preserving wealth.

Read more

The Supply & Demand Structure of Gold & How it Affects Prices

Gold, like any other product, is bought and sold using money. So, in simple terms, gold prices respond to basic supply and demand theories, where; if people’s demand for gold increases, so does its price, and the opposite is true.

Read more