Demand

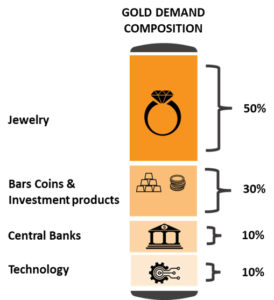

Gold, like any other product, is bought and sold using money. So, in simple terms, gold prices respond to basic supply and demand theories, where; if people’s demand for gold increases, so does its price, and the opposite is true. People’s demand for gold is affected by several factors, ranging from socio-economic and political developments to consumer sentiment and behavior. Let’s first look at the demand structure of gold. Over the past decade, on average, demand for gold has comprised 50% jewelry, 30% investments in bars, coins & investment products, 10% central banks, and 10% technological products. When demand for gold changes in any of these categories, that directly impacts price.

Demand for jewelry is one of the key determinants of price, as, on average, it represents almost 50% of worldwide demand for gold. When gold is cheaper, people’s purchasing power and affinity for gold increase. As people buy more and more jewelry, gold prices tend to increase.

As instability in equity markets persists and inflation continues to rise, investors always turn to gold bars, coins, and other investment products, as gold stores its value better than currency and acts as an inflation hedge. When demand for gold bullion by investors increases, prices also tend to increase.

Central banks also play a vital role in the demand structure of gold. Central banks hold reserves primarily in two forms: currency and gold. Since the abandonment of the gold standard and throughout the past half-century, central banks have been increasing their allocation of gold reserves to hedge against the ever-growing threat of a weakening dollar. Central banks diversify their reserve portfolio by buying more gold. This means that central banks are one of the main drivers of gold demand, and when central banks buy gold on a large scale, prices tend to increase.

Gold is used in consumer electronics and industrial and medical products. As industries become more and more dependent on technology, demand for gold as a technological component also increases. However, it is essential to note that only 10% of gold demand comes from industrial uses, making gold prices not susceptible to changes in the economic cycles compared to other commodities such as silver or platinum, which are used heavily in industry.

Supply

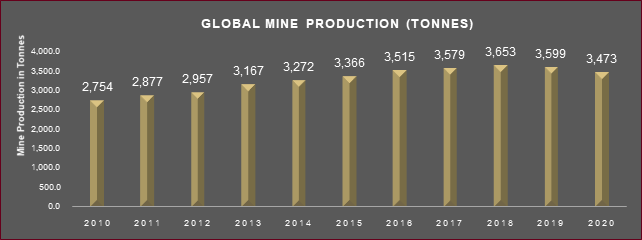

Gold is primarily supplied through two channels; the first is through mine production. Mine production has been steadily rising, reaching 3,473 tons in 2020 up from 2,754 in 2010, constituting a mere 9% increase over a decade. Historically, the supply of gold through mines has proven to be stable regardless of the world’s economic state. Since mines have a finite production volume, it is considered normal for a mine to run production until capacity is fully utilized. So, in other words, there isn’t a relationship between gold prices and mine production.

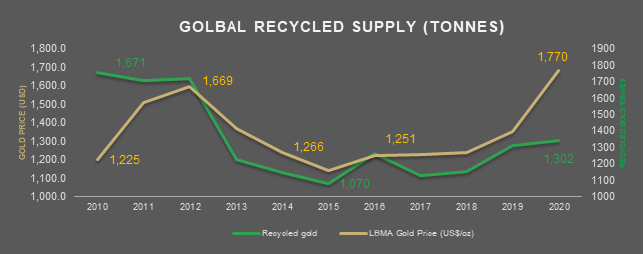

The second form of supply is recycled gold. Recycling gold is the process of melting down and refining existing gold products, and supplying it back to the market. Unlike mining, recycled gold supply is more volatile as it is a factor of global/domestic economic shocks and gold prices. Therefore, the law of supply applies to gold prices and recycled supply, where, when prices decrease, supply follows and vice-versa.

Usually, when there is an oversupply of a good, prices tend to fall, but because gold is no longer a medium of exchange and is a finite resource, there has never been an oversupply in the market. In 2020, as the COVID-19 pandemic started to unfold, we have seen a slight drop in the supply of gold due to disruptions in global supply chains and mining and quarrying activities. However, this drop in supply is not the historical trend, as supply movements have historically been. This stable supply structure is one of gold’s most treasured qualities, which plays a crucial role in keeping gold prices steady and with little price volatility, making it a safe long-term investment.

Gold benefits from diverse sources of demand and historically preserves its value over time as an investment, a reserve asset, a luxury good, and a technological component. Gold is also highly liquidity and inherently holds no liability or credit risk. With a historically steady unwavering supply, gold is expected to be a safe investment for the foreseeable future.