Financial Crisis, the Stock Market & Speculation

Gold is considered one of the most secure investment options available, as the chances of gold losing its entire worth is almost non-existent. Gold prices may fluctuate but will not collapse entirely. For this very reason, prices of the yellow metal shoot up at times of uncertainty or economic crises, as investors resort to safer investment options rather than equity market instruments, which are susceptible to several economic and geopolitical factors.

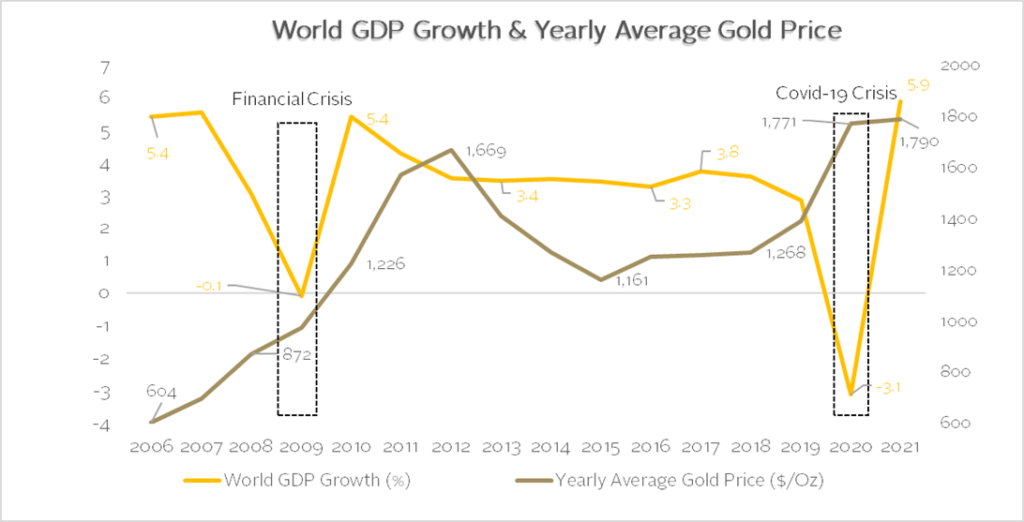

During the 2007/2008 crisis, several major indices around the world sustained a substantial hit due to the subprime mortgage crisis, and by 2009 global GDP fell -0.1%. During this period, equity markets across the globe were volatile, and investors were heavily relying on gold to preserve their capital. This triggered a massive rise in gold prices, and in the span of the two years following the crisis, gold prices almost doubled to reach the $1,900/Oz mark, recording a yearly average of $1,669/Oz in 2012.

The recent Covid-19 outbreak also brought about a steep downturn in global growth projections, where global growth dropped to almost -3% by the end of 2020, signaling the start of a deep worldwide recession. Concurrently, markets have seen a surge in international gold spot prices. In January 2020, and as the Covid-19 pandemic started to unfold, average gold prices stood at around $1,560/Oz. In April of the same year, global growth was revised downwards to -3%, as markets worldwide came to a complete standstill. Conversely, average gold prices rose to $1,683/Oz during the same period. Gold continued to surge, and by August 2020, it had reached a record $2,000/Oz, recording a yearly average $1,771/Oz in 2020.

Source: IMF WEO, World Gold Council

In 2013 gold witnessed a substantial drop of almost 30%, as market sentiment anticipated a tightening of monetary policy on the part of the Federal Reserve, cutting down on stimulus spending, which ensued the financial crises of 2008. Such an announcement suggested a downward path for inflation that, combined with an appealing stock market at the time, created unfavorable conditions for gold, as its role as an inflation hedge withered and temptation for increased returns in the equity market rose. A massive sell-off of gold followed.

More recently, U.S and global inflation has been on the rise amidst disruptions in global supply chains. This triggered a gradual rise in gold prices, as investors sought to protect their investments, utilizing gold as a safe-haven investment in times of high inflation and economic uncertainty. However, new rate hikes from the Federal Reserve and stronger performance of the dollar, have applied downwards pressures on gold prices, as investors flock to the higher yielding US dollar and treasuries.

Geopolitical Tension & Political Uncertainty

Gold prices can be affected by geopolitical tensions between nations. In early 2018 a trade war between the United States and China, two of the largest economies, began to grow. Trade tensions between two major economies of the world significantly affect several developing economies. This caused gold prices to rise in the period between 2018 and 2020. In 2017, the average gold price was $1,257/Oz, and it shot up to touch $1,390 in 2019. As political and economic instability continues to take its toll on debt and equity markets, demand for the precious yellow metal may continue to increase, rendering gold a valuable long-term investment.