Learn

What Does the Future Hold for Gold?

Gold is affected by several variables, including interest rates, inflation, the value of the dollar, demand trends, and economic and political developments. The future direction of the U.S. Fed monetary policy, stock market volatility, a looming debt crisis....

Read more

How Interest Rates, Inflation & the Dollar Affect Gold Prices?

Investing in gold is a long-term proposition; therefore, it’s best to use longer-term maturity debt instruments, such as the 10-year U.S treasuries, as a benchmark for comparison...

Read more

What are the Different Types of Gold Investments?

Almost 50% of worldwide demand for gold originates from jewelry, which is mainly attributed to its ease of access and people’s inherent affinity for it. However, jewelry is...

Read more

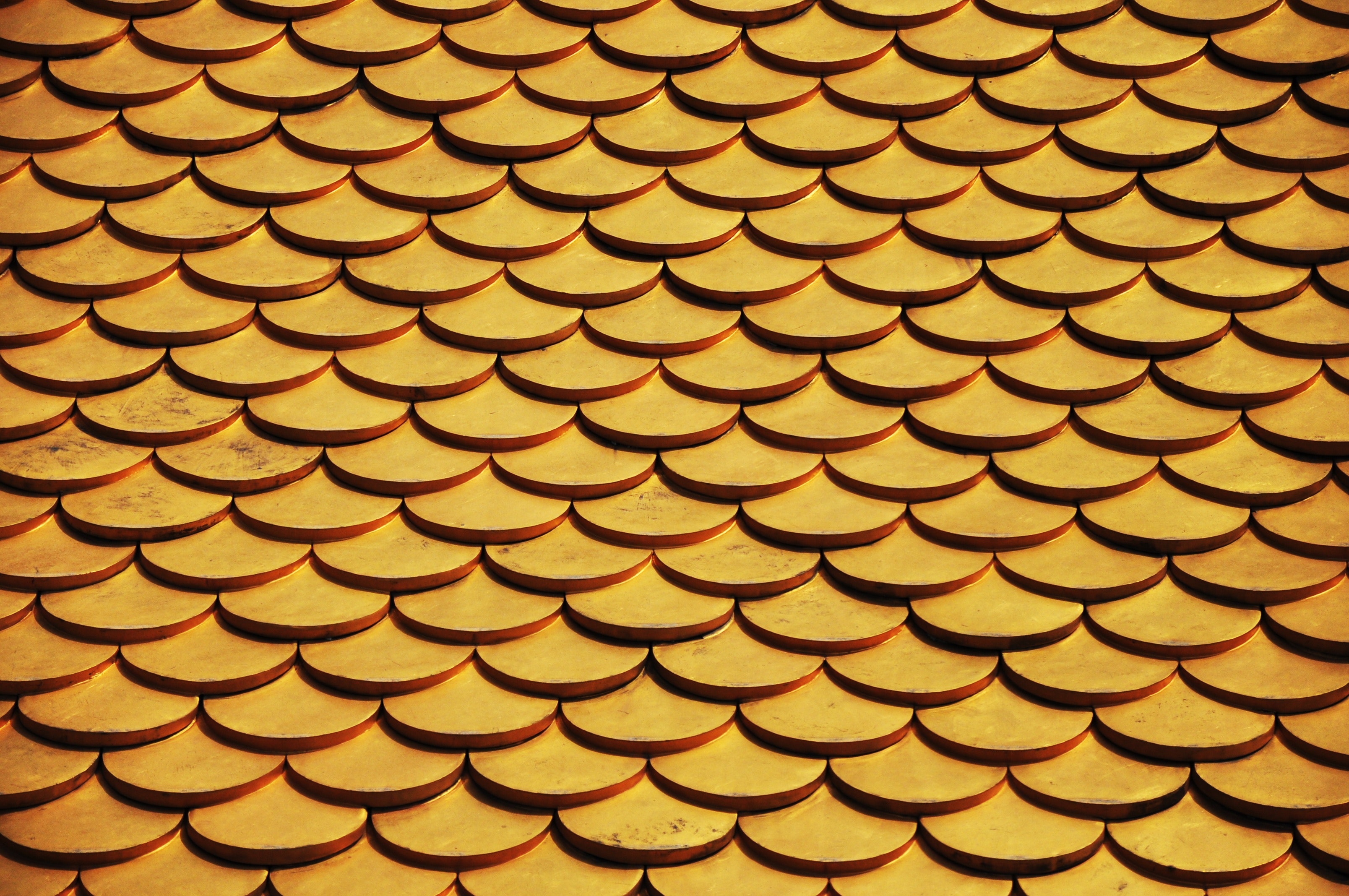

Why Invest in Gold?

Gold is an abundant natural element found in almost all corners of the world. It has been utilized for thousands of years, both a medium of exchange and a valuable commodity. It has withstood the test of time and maintained its value through the ages as a means of preserving wealth.

Read more

The Supply & Demand Structure of Gold & How it Affects Prices

Gold, like any other product, is bought and sold using money. So, in simple terms, gold prices respond to basic supply and demand theories, where; if people’s demand for gold increases, so does its price, and the opposite is true.

Read more

Egypt’s Precious Metals Ecosystem: A Game Changer for Egypt’s Financial Inclusion

In recent years, financial innovation has enabled businesses worldwide to effectively cater to customers’ needs by introducing high-tech financial products designed to reduce barriers to alternative forms of investments.

Read more